Always Benefits

Always Cash

Earn 2.5% cashback with no categories or enrollments*

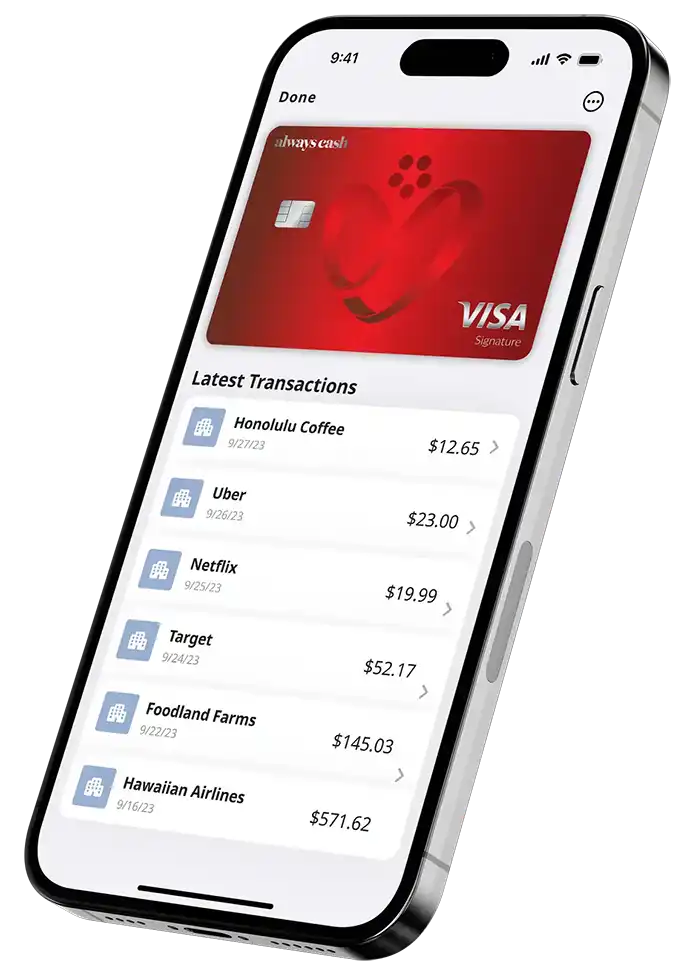

Always Convenient

In your wallet, in your phone, with on-demand redemptions

Always Right

No Annual Fees, Cash Advance Fees, Foreign Transaction Fees, or Balance Transfer Fees.

Always Secure

Set card alerts, travel notifications, lock your card, or reissue your card instantly via online banking.

See why Always is Always Right by You

| Card | Maximum potential non-category cashback | Bonus Categories | Redemption? |

|---|---|---|---|

|

|

2.5% | None | On Demand |

| First Hawaiian Bank Priority Unlimited | 2.0% | None | Once per year |

| Hawaii USA Life Matters Premium | 2.0% | None | Once per year |

| Citi Double Cash | 2.0% | None | On Demand |

| Discover IT | 2.0% | Yes | On Demand |

| Chase Freedom Unlimited | 1.5% | Yes | On Demand |

Comparison chart is for illustrative purposes only across other credit cards in market. See each issuer’s card details for full program details.

Always There...

with additional Visa® Signature benefits2

when you use your Always Cash card.

Save money by saying no at the counter – rent with your covered Hawaii State FCU Always Cash Visa Signature card and get built-in Auto Rental Coverage.

To learn more about this benefit or to file a claim, go to www.eclaimsline.com or call 1-800-348-8472. If you are outside the U.S., you can call collect: 1-804-673-1164.

Add up to an additional year to your qualifying warranty with Extended Warranty Protection, available for purchases made with your covered Hawaii State FCU Always Cash Visa Signature Rewards card.

Go to www.cardbenefitservices.com or call 1-800-551-8472 to file a claim or get your questions answered. If you are outside the U.S., you can call collect: 1-303-967-1096.

Safeguard your new item against theft or damage for the first 90 days from the date of purchase with Purchase Security, available when you pay for your item with your covered Hawaii State FCU Always Cash Visa Signature Rewards card.

To learn more about this benefit or to file a claim, go to www.cardbenefitservices.com or call the Benefit Administrator at 1-800-553-4820. If you are outside the U.S., you can call collect: 1-303-967-1096.

Use your covered Hawaii State FCU Always Cash Visa Signature Rewards card and get extra return protection any time you make an eligible purchase of an item up to $250.00.

To learn more about this benefit or to file a claim, go to www.cardbenefitservices.com or call 1-888-565-8472. If you are outside the U.S., you can call collect at 1-303-967-1096.

If an item that you purchased with your covered Hawaii State FCU Always Cash Visa Signature Rewards card appears in a print advertisement at a lower price, you can be reimbursed the difference. Keep in mind, certain items do not qualify for Price Protection. Read the Terms and Conditions for full details.

To learn more about this benefit or to file a claim, go to www.cardbenefitservices.com or call 1-800-535-7520. If you are outside the U.S., you can call collect at 1-303-967-1096.

When you pay your monthly wireless bill with your covered Hawaii State FCU Always Cash Visa Signature Rewards card, your cell phone is protected for the next calendar month. So, you can be reimbursed if your cell phone is stolen or damaged.

To learn more about this benefit or to file a claim, go to www.cardbenefitservices.com or call the Benefit Administrator at 1-866-894-8569. If you are outside the U.S., you can call collect: 1-303-967-1096.

In order for coverage to apply, you must pay your monthly eligible cellular wireless bill with your covered Hawaii State FCU Always Cash Visa Signature Rewards card.

Rate Table

| Product 1 | Terms | Current Variable Index Rate 1 |

|---|---|---|

| Always Cash Visa Signature Rewards Card | Revolving | 18.00% APR |

FAQ

Certainly! All net purchases, up to $5,000 every billing cycle, will earn our industry-leading 2.50% cash back rewards. Any amounts over $5,000 will earn rewards at 1.25% without affecting previous rewards you’ve already earned. Once your next billing cycle begins you will begin to earn 2.50% again up to another $5,000. This means you could earn 2.50% on up to $60,000 in purchases per year!

Spend Example: $6,000 in net purchases over one Billing Cycle

| Spend Tier | Earn Rate | Cashback Earned |

|---|---|---|

| First $5,000 | 2.5% | $5,000 x 2.50% = $125.00 |

| $5,001 – $6,000 | 1.25% | $1,000 x 1.25% = $12.50 |

Always Cash Rewards can be redeemed, on-demand, soon as they are available! It’s easy to redeem! Simply log on to online banking, click on “redeem” within your card and choose one of the following methods:

- Redeem immediately to one of your linked deposit Hawaii State FCU accounts.

- Redeem for statement credit – generally applied within 3 business days.

If you are having trouble with online access, you may also call in at (808-587-2700) to request assistance with a redemption.

Your physical card should arrive within 7-10 days. However, generally within 2 days of your card being approved an option will appear in online banking to digitally add your card to your wallet! This means you can spend and start earning rewards before your physical card arrives.

Balance transfers are not permitted on internal HSFCU cards however, you may request a balance transfer from a non-HSFCU card with no balance transfer fee. This may be done via card services in online banking, visiting a branch or contacting Cardholder Services at (866-820-6821).

Have Questions?

Disclosures

1. Earn 2.50% cash back on net purchases up to $5,000 each billing cycle. After that, a 1.25% cash back will apply to additional net purchases. The variable APR for Purchases, Balance Transfers and Cash Advances for the Always Cash card is 18%, when you open your Account, based on your creditworthiness. The APRs are current as of 10/1/2024 and will vary with the market based on the U.S. Prime Rate. Rates are subject to change at any time without prior notice. We will not charge an APR greater than the maximum that we are permitted to charge by law (currently 18.0%). Cash Rewards are based on net purchases. Minimum credit line is $5,000 for the Always Cash card. Certain terms and conditions apply. Credit union membership required. Contact us for eligibility. Hawaii residency required for new accounts.

2. No Cash Advance Fee, No Balance Transfer Fee, No Foreign Transaction Fee. Must be a Hawaii resident.

- © 2024 Hawaii State Federal Credit Union

- Federally insured by NCUA